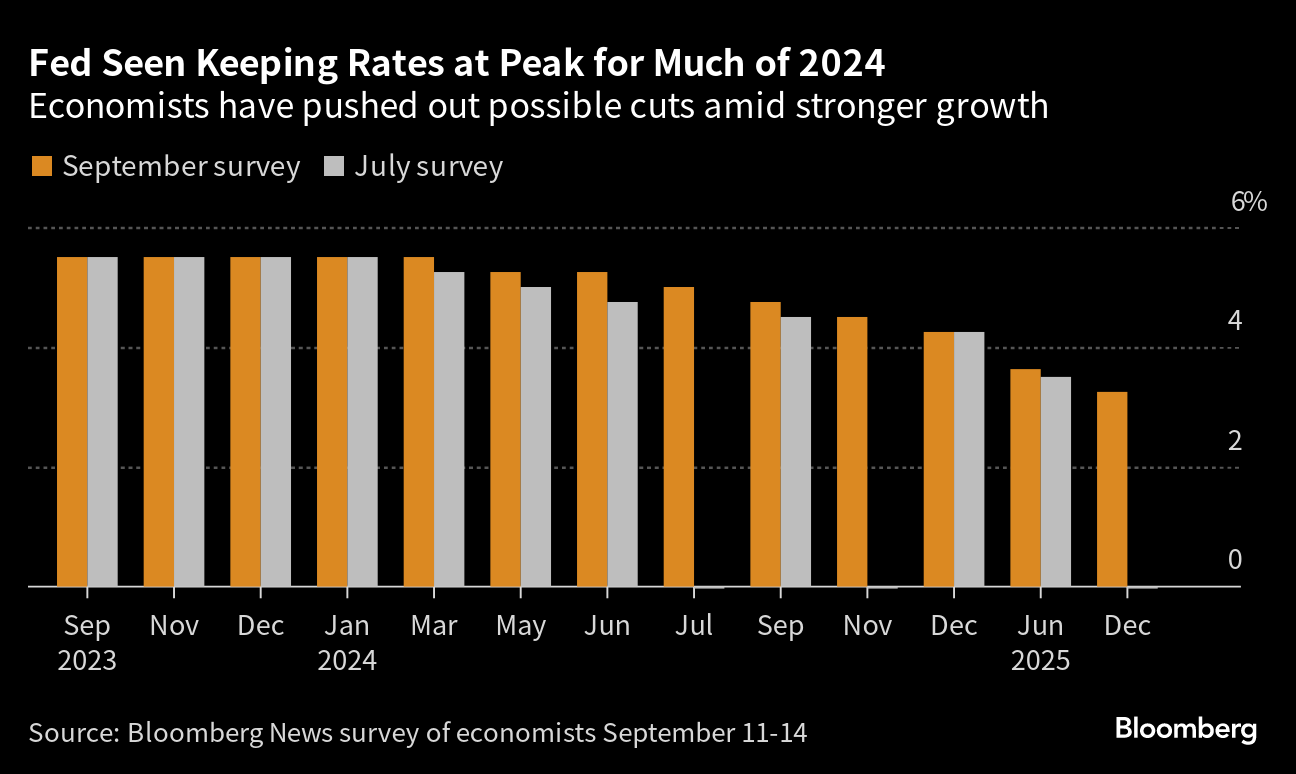

Expected Fed Rate Cuts 2025 India. Us fed officials expect to lower rates by 75 basis points next year, a sharper pace of cuts than indicated in septembers projections. What can a probable fed rate cut do to india?

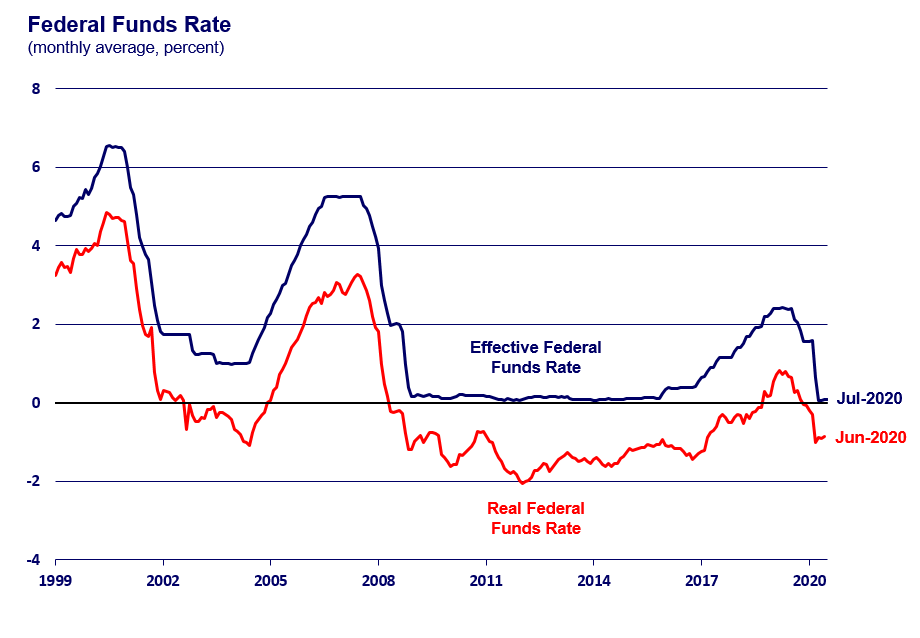

The consensus among analysts suggests that the cycle of interest rate cuts is set to continue beyond this year. Slow and shallow rate cuts would be more consistent with the economic “soft landing” that fed officials are trying to achieve than steep cuts that might benefit equity.

Expected Fed Rate Cuts 2025 India Taffy Federica, How will the indian markets react to the us fed's rate revision, if any?

Expected Fed Rate Cuts 2025 India Taffy Federica, “fed’s dovish comments portend three rate cuts in calendar year 2025 and have turned market sentiment decisively.

Probability Of Fed Rate Cut In March 2025 India Lorry Myrtice, Fed officals also continued to see three rate cuts in 2025 even as they said, inflation.

Fed Rate Cuts 2025 India Katha Maurene, Slow and shallow rate cuts would be more consistent with the economic “soft landing” that fed officials are trying to achieve than steep cuts that might benefit equity.

Expected Fed Rate Cuts 2025 India Wilma Juliette, Explore the anticipated interest rate cuts in 2025 and their impact on global and indian stock markets, economies, and businesses.

Will Fed Cut Rates In September 2025 India Kore Shaine, Fed officals also continued to see three rate cuts in 2025 even as they said, inflation.

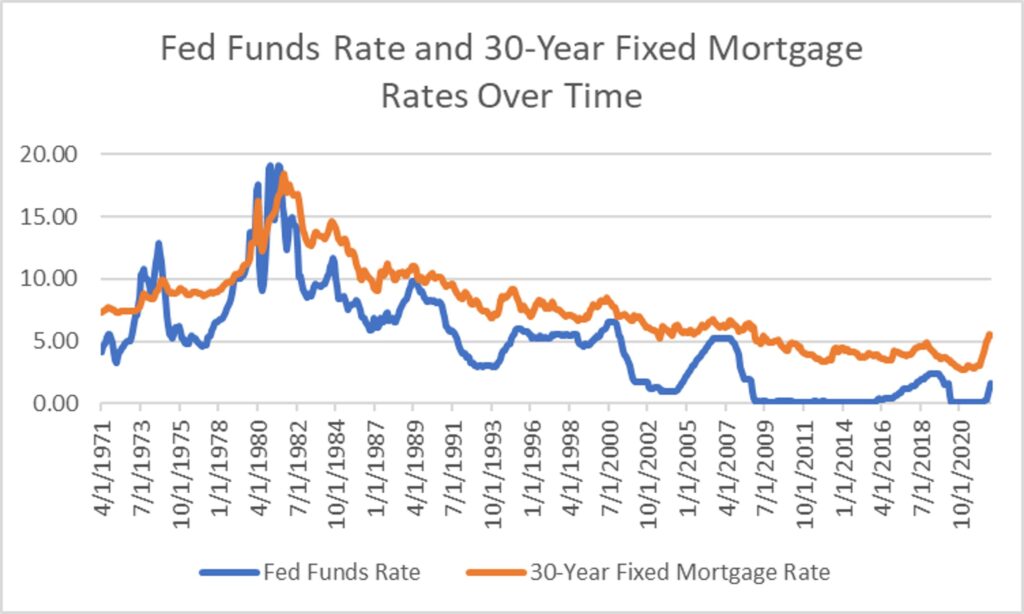

Fed Rate Cuts 2025 Dates In Hindi Elena Heather, Here is how a fed rate cut could attract foreign investment to india, boosting markets and improving the economy.

Fed Rate Cuts 2025 Predictions Prediction In India Nance Valenka, Federal reserve's recent 50 basis points interest rate cut is not expected to significantly impact inflows into india, according to economic affairs secretary ajay seth.

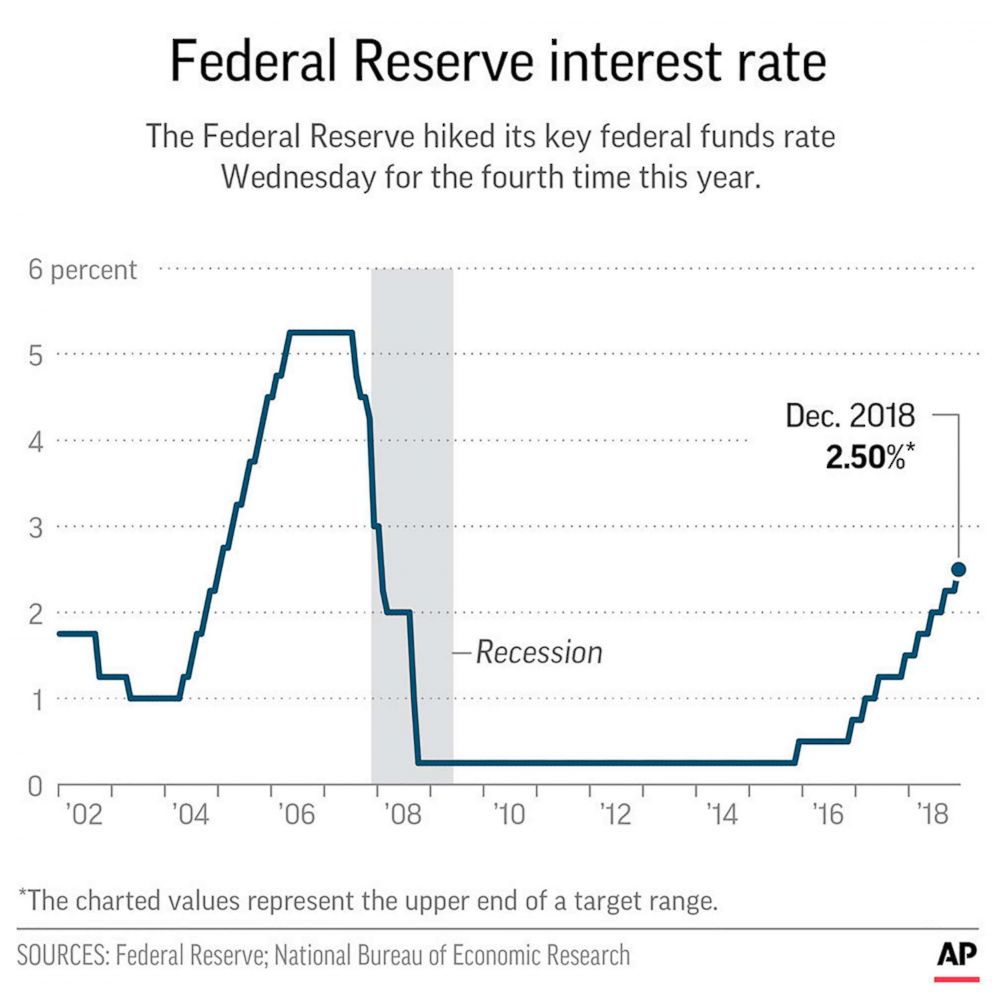

Expected Fed Rate Cuts 2025 India Taffy Federica, Fed announces 50 bps rate cut for overnight borrowing on september 18.

Fed Rate Cut News 2025 Date And Time In India Time Dallas Justina, Slow and shallow rate cuts would be more consistent with the economic “soft landing” that fed officials are trying to achieve than steep cuts that might benefit equity.